Microsoft Excel is one of the best tools for creating and managing a personal or business budget. You can track income, expenses, savings, and spending categories—all with built-in formulas and charts.

Here’s a beginner-friendly guide to using Excel for budgeting:

1. Start a New Workbook

- Open Excel and choose Blank Workbook

- Save the file as something like Monthly Budget 2025.xlsx

2. Set Up Your Budget Categories

In your worksheet, create headers like this:

| Category | Planned Amount | Actual Amount | Difference |

|---|---|---|---|

| Income | |||

| Salary | $3,000 | $3,000 | |

| Freelance | $500 | $450 | |

| Total Income | |||

| Expenses | |||

| Rent | $1,000 | $1,000 | |

| Groceries | $300 | $320 | |

| Utilities | $150 | $130 | |

| Subscriptions | $50 | $60 | |

| Total Expenses | |||

| Net Balance |

3. Enter Formulas

Let Excel do the math:

- Total Income:

=SUM(B2:B3)and=SUM(C2:C3) - Total Expenses:

=SUM(B7:B10)and=SUM(C7:C10) - Net Balance:

=B4 - B11and=C4 - C11 - Difference column:

=B2 - C2(copy down)

This shows the gap between planned and actual for each item.

4. Use Formatting to Stay Organized

- Bold the totals and headings

- Use color to separate income from expenses

- Format currency columns: Select cells → Home > Number > Currency

5. Add Conditional Formatting (Optional)

Highlight overspending:

- Select the Difference column

- Go to Home > Conditional Formatting > Highlight Cell Rules > Less Than

- Set it to highlight values less than

0in red

This visually flags categories where you spent more than planned.

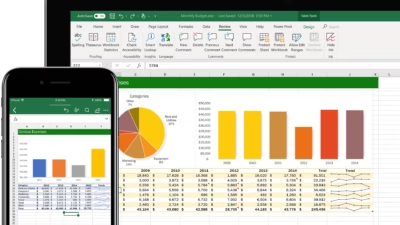

6. Use a Chart to Visualize Spending

- Select the expense categories and actual values

- Go to Insert > Chart > Pie Chart or Column Chart

- Add a title like “Monthly Spending Breakdown”

7. Track Your Budget Monthly

You can:

- Use separate sheets for each month

- Or create a dropdown menu to switch months with formulas tied to it

- Or build a summary sheet showing yearly totals

8. Use a Template (Optional)

Excel has built-in budget templates:

- Open Excel

- Go to File > New

- Search for “Budget” and choose one (e.g., Personal Monthly Budget)

- Customize the template to fit your needs

Tips

- Update your budget weekly to stay on track

- Add notes or comments for unexpected expenses

- Back up your file in OneDrive or Google Drive